RANKING LUXURY

Live Beautifully

The Battle of the BRANDS

Luxury is not exclusive to a single brand. It spans the globe, largely controlled by five major companies that own over 50 brands, each vying for sales, prestige, and prime real estate. Walk down Via Montenapoleone, Madison Avenue, or even through the Dubai Mall, and the scene remains the same: store after store of the world’s top luxury brands, dripping with high-end merchandise, begging you to shop with enticing window displays, baubles that shine, and coordinated outfits you couldn’t imagine wearing as you stand in your bathroom mirror.

So, who are the power players in the industry and how do they stack up?

LVMH Moët Hennessy Louis Vuitton (Paris-based) is the most diverse luxury conglomerate, with a portfolio spanning fashion, spirits, watches, jewelry, cosmetics, and more. Best known for its flagship Louis Vuitton brand, LVMH also owns Sephora, Bulgari, Tiffany, Dior, TAG Heuer, and Dom Pérignon, among others. Bernard Arnault, the Chairman of the family-controlled company, approaches his investments in measured tones by first dipping his toe in the brand before seizing control and totally remaking it. An interesting little-known fact: LVMH once owned a 17% stake in Hermes (Mon Dieu!) before agreeing to distribute the shares back to the founding family. Wonder what that was about?

Richemont (Swiss-based) is predominantly recognized for its watch and jewelry houses including Cartier, Van Cleef & Arpels, Montblanc, and Buccellati. It also owns fashion labels such as Dunhill, Chloé, and sportswear brand Peter Millar. In an odd twist, Richemont is the owner of British gun maker, Purdey. Security is always important.

Kering (Paris-based) has built a multibillion-dollar empire with brands like Gucci, Saint Laurent, Brioni, Pomellato, and fragrance power Creed, while also owning little-known brands Qeelin (oriental-inspired jewelry) and DoDo, which sells luxury charm bracelets. A privately owned company, its CEO is married to actress Salma Hayek. (Now there is some marketing power.)

Hermès, well...it's Hermès, remains in a league of its own. Primarily owned by the Dumas family, the brand has solidified its status through its highly coveted handbags and has expanded into high-end apparel, perfumes, watches, jewelry, and home décor. With its roots firmly in the saddle of equestrian beginnings, much of its offerings contain the status of the sports. It is, after all, Hermès.

Chanel, privately owned like Hermès, thrived under Karl Lagerfeld’s design leadership. It has leveraged its handbag popularity to establish dominance in fashion, fragrance, and accessories, pulling in approximately $20B annually, but few know that Chanel has a stake in watchmaker Bell & Ross and feather and flower purveyor Lemairé.

Billion-dollar annual volume aside, it is many times the influence that a brand has that powers its sales to consumers, and measuring that influence now has its own scorecard.

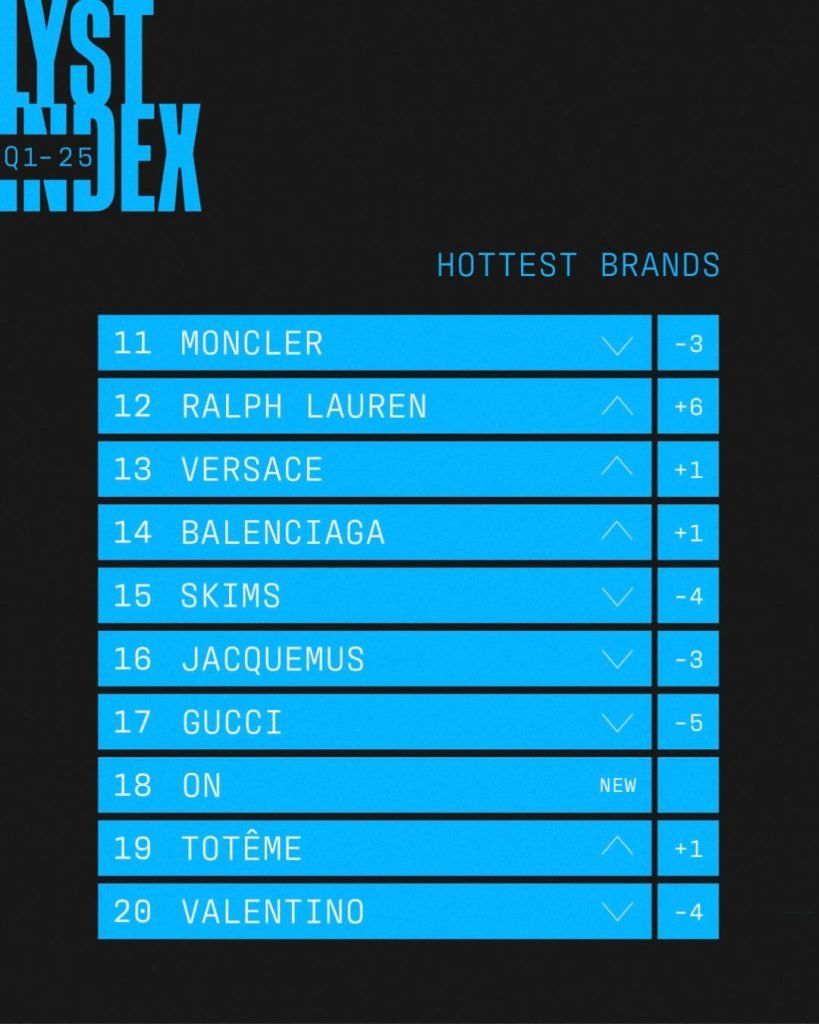

THE LYST INDEX

Ranking the power of these parent companies is challenging, as sales volume does not always equate to influence. Financial reports from The Financial Times, Vogue Business, and The Business of Fashion track quarterly performance, but a new player in fashion analytics, The Lyst Index, provides a fresh perspective on this topic, and it does so on a quarterly basis. Lyst goes deep into specifics of a collection or even a single item which can easily sway consumers for or against a purchase. This matters.

Founded in London in 2010, Lyst is a digital platform with over 200 million users, curating eight million fashion items from more than 27,000 labels. Using this core structure helps Lyst analyze consumer activity. The Lyst Index assesses quarterly brand performance based on popularity, identifying what’s trending and what’s not. Is it a “what’s hot and what’s not” list? You could say so, and their analysis has started to matter to not only consumers but the brands themselves.

For instance, in Q2 2024, Loewe (pronounced loh-EV-ay) surged to the #1 spot after launching its ‘I Told Ya’ Collection (featured in the Challengers movie), hosting the Loewe Foundation Craft Prize in Tokyo, and supporting ($$$) the Met Gala. Apparently, money can buy you love because that spot was previously held by the famed Italian brand Prada. Conversely, Balenciaga plummeted 10 spots due to poor sales of its City Bag, despite a high-profile campaign featuring Nicole Kidman and Kate Moss. To put it simply, the bag did not sell. Additionally, the brand’s Paris fashion show, "Fashion with a Point of View," was widely panned. Perhaps they should have come up with a more confident title?

One notable riser in The Lyst Index is Alaïa, a once-niche Parisian house that saw 109% sales growth over the last 12 months. By opening boutiques in Las Vegas and Orange County, California, Alaïa secured the #7 spot on The Lyst Index, trailing just behind the $1.5 billion powerhouse Bottega Veneta.

THE IMPACT OF MARKETING & CONTROVERSY

A single product launch or marketing campaign can make or break a brand. A prime example is Balenciaga’s 2022 scandal, where an ad campaign featuring children holding teddy bears in bondage-style accessories sparked worldwide outrage. The backlash was severe, causing a steep decline in brand perception. It has taken nearly two years for Balenciaga to rebuild consumer trust and regain market standing. Conversely, Calvin Klein created a jean obsession when he featured cover girl Brooke Shields wrapped in only denim with the tagline, “Nothing comes between me and my Calvin’s.” Instant success followed.

THE ROLE OF LUXURY REAL ESTATE

Despite generating over $160 billion in combined annual sales, luxury brands understand that location is everything.

- Louis Vuitton closed its iconic 57th & Fifth Avenue store for a multi-million-dollar ground-up renovation (set to take five years), temporarily re-locating across the street in the 65,000 sq ft former Nike store, owned by The Trump Organization, where sales have surged by 35% monthly. That’s quite a rental! They also just recently opened a newly renovated palace of 50,000 sq ft in the Montenapoleone district in Milan which features a partnership with a three-star Michelin restaurant. Bono!

- Hermès recently opened a new two-story ‘Maison’ on Madison Avenue, featuring an expanded home collection and expansive equestrian line of saddles, crops, and accessories. You might say it’s ‘one-stop shopping’.

- Dior is set to unveil its Peter Marino-designed 55,000-square-foot flagship on 57th & Madison, reinforcing its dominance as a leading fashion house.

- Cartier is expanding in Palm Beach, moving into a 3,800-square-foot space at the former Flagler Playhouse, a major upgrade from its current 1,000-square-foot boutique.

The luxury market is thriving post-pandemic, continuing the ongoing battle between brand supremacy. Whether shopping in Las Vegas, Beverly Hills, Palm Beach, Manhattan, or Milan, consumers benefit from an evolving landscape where exclusivity, prestige, and accessibility collide, all within walking distance of one another.

Christina Grazia Poggi is an Italian writer living in Como, Italy. She has graciously written for WQ Magazine in the past and spends her weekends finding the ‘hidden gems’ of Italian culture and fashion.